Birzha is a legal entity that ensures the regular functioning of the organized market for exchange goods , currencies , securities and derivative financial instruments . Trading is conducted by standard contracts or parties ( lots ), the size of which is regulated by the regulatory documents of the exchange.

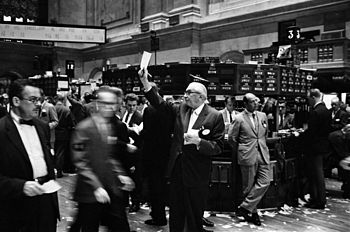

The outdated meaning of the word is a place or building where trading people, intermediaries, stock brokers gather at certain hours to conclude transactions with securities or goods [1] .

Before the era of computerization, the parties agreed orally. Now, trading is mostly held in electronic form using specialized programs, many exchanges have abandoned trading floors [2] . Brokers, in their own interests or in the interests of clients, submit applications for the purchase or sale of exchange goods in trading systems. These applications are satisfied by the counter applications of other merchants. The exchange keeps records of executed transactions, implements, organizes and guarantees settlements ( clearing ), provides a mechanism of interaction “ delivery versus payment ”.

Typically, exchanges receive a commission fee for each transaction concluded with their help, this is the main source of their income. Other sources may include membership fees, fees for access to trading, sale of stock information.

Content

- 1 Etymology

- 2 History

- 3 Exchange Features

- 4 Classification of exchanges

- 5 Types of transactions

- 6 Regulation

- 7 Games

- 8 History in Russia

- 8.1 The first exchange in Russia

- 8.2 During the NEP

- 8.3 Modernity

- 9 See also

- 10 notes

- 11 Links

Etymology

The history of the emergence of exchanges refers to the XII-XV centuries. and begins with bill fairs in Venice , Genoa , Florence , Champagne , Bruges , London . [3] In Bruges ( West Flanders ), bill trades were held on the square where the house of the old Van Der Bursa family stood, on the coat of arms of which three leather bags (purses) were depicted. The meeting of the merchants in the square was called “Borsa”, which means “wallet”. It was there, on the territory of modern Belgium in 1406 , the first exchange was founded [4] .

History

- In the 16th century , the first two stock exchanges opened and closed - in Antwerp and Lyon. At these exchanges, trading was held not only with bills, but also with government loans. Official exchange rates were also established.

- In the 17th century , the world's oldest Amsterdam stock exchange was created.

- At the end of the 17th century, the London Stock Exchange (LSE) was created. It was here that the concepts of “bulls” and “bears” first appeared as players on the exchange.

- The New York Stock Exchange (NYSE) was founded on May 17, 1792 .

- Tokyo Stock Exchange was founded in 1878. [3]

Exchange Functions

- organization of exchange trading;

- establishing trade rules, including standards for goods sold through the exchange;

- development of model contracts;

- quotation ;

- settlement (arbitration) of disputes;

- informational activity;

- providing certain guarantees for the performance of obligations by bidders.

Exchange Classification

Depending on the traded assets (instruments), exchanges are divided into:

- commodity

- stock

- currency

- futures

- optional

- labor

- rates

However, there have always been universal exchanges - exchanges that combine the organization of trading with various instruments within the same organizational structure (often in different sections).

Transaction Types

- Long position (purchase of a financial instrument - stocks, bonds, currencies, futures, options, etc. - based on the growth of its value)

- Short position (sale without coverage, that is, securities are borrowed and sold in the expectation of a drop in their value, the repurchase of a depreciated asset and repayment to the creditor are provided)

Regulation of Activities

In Europe, regulatory systems are moving towards the establishment of common rules for the work of exchanges; since November 1, 2007, the EU Directive on Financial Instrument Markets ( MiFID ) has been enacted.

Games

Several games have been created simulating the exchange. Among them:

- Shareholder (game)

- Broker (game)

- Broker +1 (game)

- Strong Hold (game)

History in Russia

First Exchange in Russia

In Russia, the first exchange was created by Peter I in 1703 in St. Petersburg. [5] .

In the days of the NEP

The first Soviet exchanges appeared in the USSR in the summer of 1921 - Saratov, Perm, Vyatka, Nizhny Novgorod and Rostov.

They were cooperative, but with the advent of the Moscow Central Commodity Exchange of the Supreme Economic Council and the Central Union at the end of December 1921, the cooperative exchange was replaced by a “mixed” one with the Supreme Economic Council, and in the first half of 1922 all exchanges were reformed in accordance with the charter of the Moscow Exchange.

The Soviet exchanges were tasked with identifying supply and demand, regulating trade operations, as well as monitoring the correctness and economic feasibility of transactions.

On January 2, 1922, the Supreme Economic Council issued an order on the participation of state-owned enterprises and organizations in exchange transactions and opened schools of "commercial literacy", but at first the enterprises avoided participating in exchange transactions. The quotation on the Moscow Exchange began 10 months after the date of its formation; Until the summer of 1922, quotations were made only on 24 of the 39 existing exchanges. Private individuals could not be members of Soviet exchanges, although they were allowed to exchange meetings if they were regular visitors and paid an annual fee. As a result, the share of private capital involved in exchange transactions was significantly lower than the share of state structures. In 1923, the average annual percentage of private capital in the exchange turnover did not exceed 15.5%, and its growth rate was much lower than state turnover: 11% against 45%.

In 1923, there were already 70 exchanges in the USSR.

But the state regarded them as a tool for “mastering the market” and forcing the private owner out of the economic sphere.

In September 1922, the service station obliged state agencies to execute transactions on the exchange committed outside the exchange. Since exchanges levied higher fees for the registration of OTC transactions as compared with exchange transactions, this resolution contributed to an artificial increase in exchange turnover [6] .

At the beginning of 1927, the Council of People's Commissars and the Council of Labor and Defense adopted a decision restricting the operation of exchanges, and as a result 56 of 70 exchanges remained, and in 1929-1930. and they were closed.

Modernity

After the collapse of the USSR, exchanges began to appear in Russia, the number of which grew very rapidly. In the short term, the number of registered exchanges in Russia exceeded the total number of operating exchanges in the world. However, not all of them really worked.

Since January 1, 2014, Russian legislation does not provide for the division of exchanges into currency , commodity and stock exchanges ; the term “exchange” is used to designate all of the above types (clause 6 of article 29 of the Federal Law of 21.11.2011 N 325-ФЗ (as amended of 12/21/2013) “On Organized Tenders”), and their activity is regulated by the Federal Law “On organized tenders ”and other regulatory acts.

The state obliges some manufacturers to sell part of the products on the exchange. For example, according to a joint order of the Federal Antimonopoly Service and the Ministry of Energy of Russia , the largest oil companies are obliged to sell at least 10% of the produced gasoline and jet fuel and 5% of diesel fuel on the stock exchange, and the government ordered the fulfillment of imputed obligations by special decrees [7] .

See also

- List of European Stock Exchanges

- List of stock exchanges

- OTC transaction

- Listing (economics)

- Forex trading

- Million dollar traders

- Exchange Committees

Notes

- ↑ Small Encyclopedic Dictionary of Brockhaus and Efron.

- ↑ “Iron broker: how robots drive traders from exchanges around the world” RT dated November 8, 2017

- ↑ 1 2 Eric Nyman Small Encyclopedia of the Trader. - M .: Alpina Publisher. - 2002.

- ↑ Kulisher I.M. Exchange History (as presented) // Banking Encyclopedia. Kiev: Bank. encycl., 1916. T.II. S. 40-75.

- ↑ Economic theory. 4th edition. Textbook for high schools. A.I. Popov (page 64). Publishing house "PETER".

- ↑ "Russia is NEP" (under the editorship of A. Yakovlev) - M, 2002.

- ↑ Rosneft short-lived the independent Kommersant Newspaper No. 211 of 11/16/2018, p. 7.

Links

- Exchange // Brockhaus and Efron Encyclopedic Dictionary : in 86 volumes (82 volumes and 4 additional). - SPb. , 1890-1907.

- Moshensky S.Z. The Origin of Financial Capitalism. Securities market of the pre-industrial era . - K .: Planet, 2016 .-- 269 p. - ISBN 978-966-8851-08-7 .